Understanding the Meaning and Power of the Proforma Invoice

Introduction: The Pre-Sale Commitment

The Hook: Before cargo is loaded, before customs are prepared, and often before money changes hands, there is the Proforma Invoice (PI). While it may look like a regular invoice, it holds a unique, non-binding power that drives the entire international sales cycle.

The Problem: Many businesses confuse the PI with the final Commercial Invoice (CI), leading to later issues with financing, customs declarations, or inventory planning.

The Globax View: At Globax Solutions, we recognize the PI as the crucial blueprint for the future transaction. Mastering its meaning and format is the first step toward a successful, complication-free export.

What You Will Learn: This guide will clearly define the Proforma Invoice, outline its mandatory uses, and explain how it differs from the legally binding Commercial Invoice.

Section 1: What is a Proforma Invoice?

The term “Proforma” means “for the sake of form” or “as a matter of form.”

A Proforma Invoice is a preliminary bill of sale sent by the seller (exporter) to the buyer (importer) in advance of a final shipment or delivery of goods.

1.1 The Defining Characteristics

It is NOT a Demand for Payment: The PI is an estimated quote or an offer to sell, not a legally enforceable request for funds.

It is Subject to Change: While intended to be accurate, the quantities, prices, and even shipping dates can be adjusted until the final Commercial Invoice is issued.

Its Purpose is Confirmation: It confirms the seller’s commitment to provide the goods and the buyer’s commitment to purchase them under the stated terms.

Section 2: The Mandatory Uses of the Proforma Invoice

The PI is a vital document that serves several distinct, mandatory functions in global trade that the final Commercial Invoice cannot:

1. Securing Financing and Payment

Letters of Credit (L/C): Banks often require the PI before they will open a Letter of Credit, as it establishes the fundamental value and terms the L/C will guarantee.

Pre-Payment: When the seller requires payment in advance, the PI is the document used to request and justify the funds transfer.

2. Customs and Import Licensing

Import Permits: In many countries, the buyer must present the PI to their government to secure an import license or permit before the goods can legally be shipped.

Foreign Exchange Allocation: In countries with strict currency controls, the PI is used to apply for the necessary foreign exchange allocation to pay for the imports.

Valuation Estimate: It provides the local customs authority with an early estimate of the consignment value for preliminary duty calculations.

3. Internal Planning and Budgeting

The buyer uses the PI to calculate and budget for the final landed costs, including estimated duties, taxes, and final logistics charges based on the stated Incoterm.

Section 3: Proforma Invoice vs. Commercial Invoice

Confusing these two documents is the most common documentation mistake in exporting. While they share many fields, their function is fundamentally different.

| Feature | Proforma Invoice (PI) | Commercial Invoice (CI) |

| Timing | Sent BEFORE goods are shipped. | Sent AFTER goods are shipped. |

| Purpose | Quote/Offer; Secures L/C/Import Permits. | Demand for Payment; Final Customs Declaration. |

| Legality | Non-binding agreement (offer to sell). | Legally binding sales document. |

| Value | Estimated/Proposed value. | Final, actual value used for customs duty. |

Section 4: Essential Format Requirements for the PI

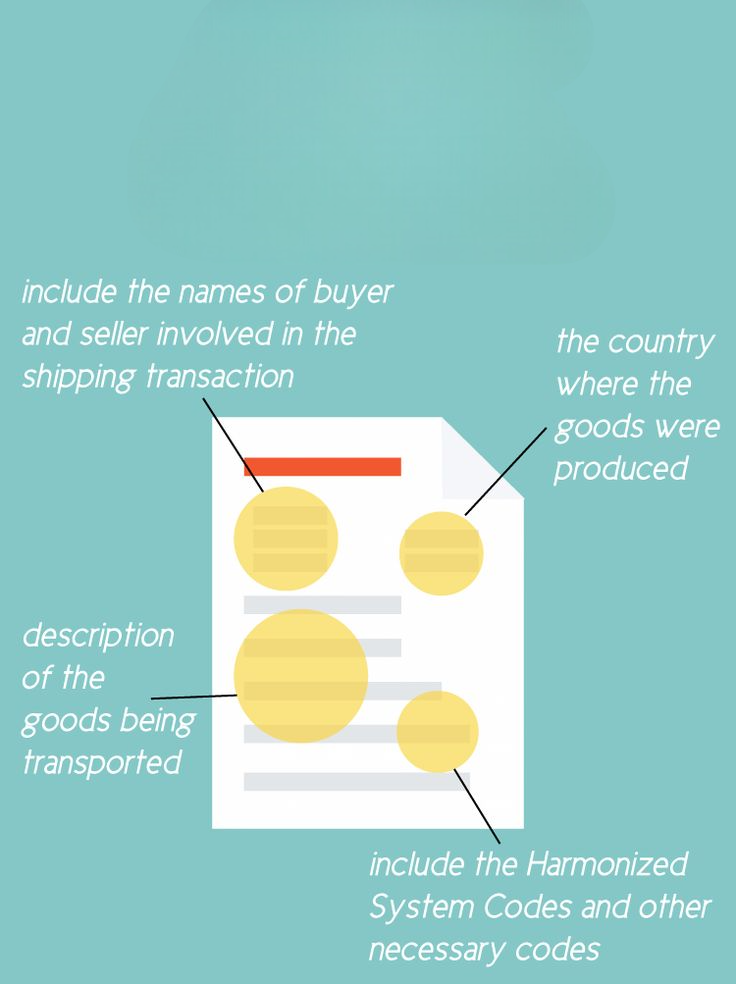

To ensure the PI fulfills its purpose, it must follow a rigorous format, mirroring the CI while clearly marking its preliminary status.

Clear Title: Must explicitly state “PROFORMA INVOICE” at the top.

Date and Expiration: Include an issue date and an expiration date for the quote (e.g., “Prices valid for 30 days”).

Parties and References: Full exporter and consignee details, including tax IDs.

Incoterms® 2020: The agreed-upon term (e.g., FOB, CIF, DAP) and the named place, as this defines the estimated final cost and delivery terms.

Detailed Goods Description: Including the item name, model numbers, and the corresponding HS Code (Harmonized System Code).

Price and Currency: Itemized unit price and total value, with the currency clearly stated (e.g., $5,000 USD).

Estimated Charges: A clear breakdown of estimated freight and insurance costs, if those charges are part of the Incoterm.

Signature: Must be signed by the seller/exporter.

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800