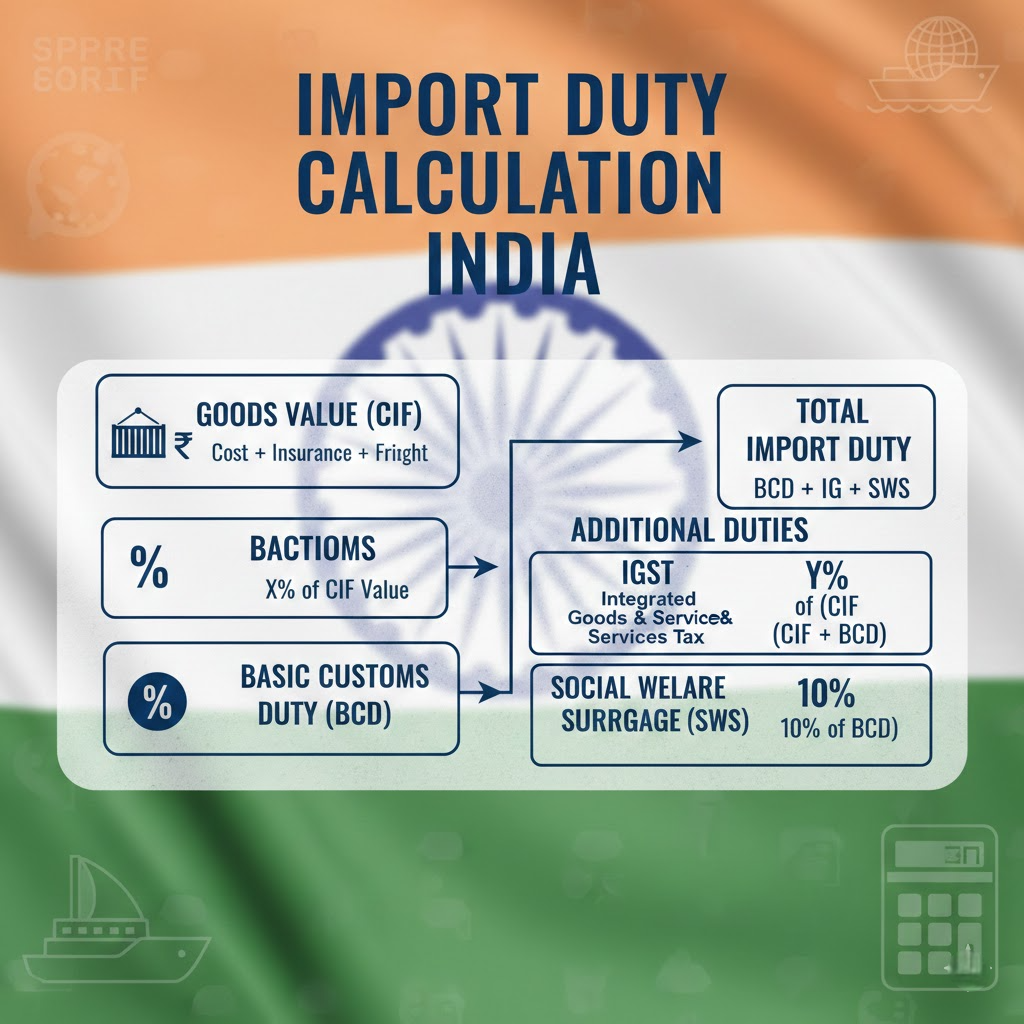

Your Guide to Import Duty Calculation in India

1.The Foundation: Determine the Assessable Value (AV)

Before any duty can be applied, Customs must establish the Assessable Value (AV) of the goods. This is the base value used for calculating the primary duty components. As per the Customs Valuation Rules, 2007, the AV is based on the Transaction Value (the price paid for the goods) plus certain mandatory additions up to the place of importation.

The AV is typically calculated on a Cost, Insurance, and Freight (CIF) basis.

Key Rules for Valuation:

Freight: If the actual international freight charges are unknown, Customs assumes them to be 20% of the FOB value.

Insurance: If the actual insurance cost is unknown, Customs assumes it to be 1.125% of the FOB value.

Exchange Rate: The foreign currency is converted to Indian Rupees (INR) using the exchange rate published by the CBIC (Central Board of Indirect Taxes and Customs) on the date the Bill of Entry is filed.

2.The Critical First Step: The 8-Digit ITC-HS Code

The Harmonized System (HS) Code (or ITC-HS Code in India) is the single most important factor. The specific 8-digit code determines the applicable rates for almost all duties.

Action: Always verify your product’s 8-digit code against the official Indian Customs Tariff Schedule to find the specific rates for Basic Customs Duty (BCD) and Integrated GST (IGST).

Risk: Using an incorrect code can lead to payment of a higher duty (overpayment) or underpayment, resulting in fines and goods seizure.

3.The Duty Components: A Step-by-Step Calculation

Import duty calculation in India is a chain reaction. Duties are applied sequentially, and later duties (like IGST) are calculated on the value inclusive of the previously applied duties.

Step 1: Calculate Basic Customs Duty (BCD)

This is the primary duty levied on the Assessable Value.

Calculation Base: Assessable Value (AV).

Rate: Varies widely (from 0% to over 100%) as per the ITC-HS Code and any applicable Preferential Trade Agreements (FTAs).

Step 2: Calculate Social Welfare Surcharge (SWS)

This is a surcharge levied to fund social welfare programs.

Calculation Base: The BCD Amount.

Rate: Generally 10% of the BCD Amount (unless the BCD itself is zero or specifically exempted).

Step 3: Calculate Integrated Goods and Services Tax (IGST)

This is the tax levied on imports, equivalent to the domestic GST, and is applied to the full “landed cost” for tax purposes.

Calculation Base (IGST Value): The sum of the Assessable Value, BCD, and SWS.

Rate: Matches the domestic GST rate for that product (typically 5%, 12%, 18%, or 28%). This tax is typically recoverable for registered businesses through Input Tax Credit (ITC).

Step 4: The Grand Total

The total customs duty and taxes payable to clear the goods for home consumption is the sum of the duties calculated above, plus any additional levies.

4.Other Applicable Duties (If Any)

Certain goods and specific trade scenarios may attract additional duties designed to regulate markets or protect domestic industry:

Anti-Dumping Duty (ADD): Imposed on imports sold at prices below their normal value in the exporting country, causing injury to Indian industry.

Safeguard Duty (SD): Imposed temporarily to protect domestic industry from injury caused by a sudden surge in imports.

Compensation Cess: Applicable only to certain goods like tobacco products, luxury cars, and aerated drinks. It is calculated similarly to the IGST (on the AV + BCD).

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800