Customs Clear! What is the HS Code and Why is it Essential for Global Trade (Globax Solutions Guide)

What is the HS Code?

The full form of HS Code is the Harmonized System of Nomenclature.

It is an international standardized system developed by the World Customs Organization (WCO).

Its primary purpose is to uniformly classify over 98% of all products traded globally under a common numbering system.

This code is used by approximately 200+ countries for collecting customs duties, tariffs, and trade data.

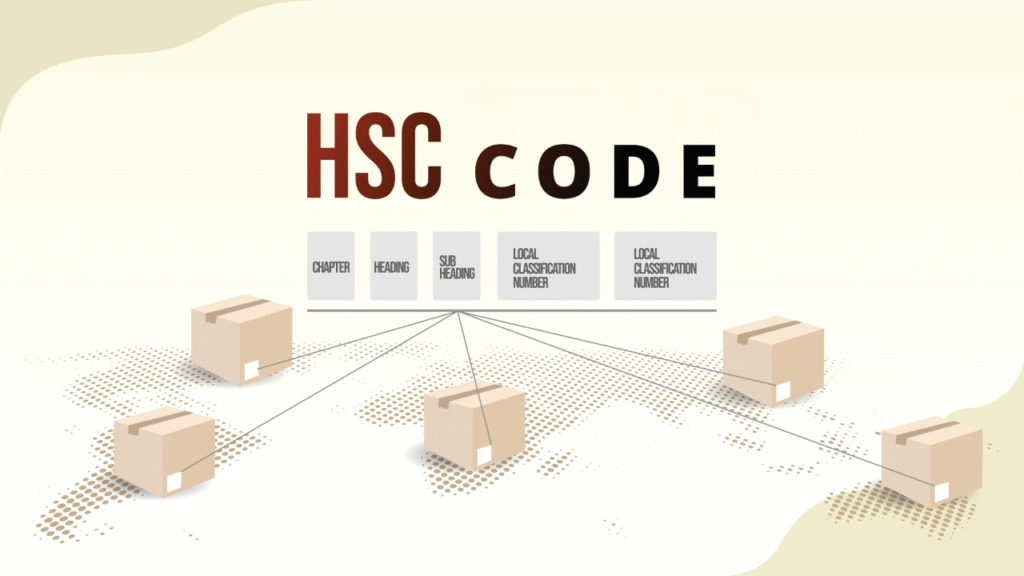

The Structure of the HS Code

The HS Code structure operates hierarchically, classifying a product from a general category to a specific one. Internationally, the code is 6 digits long, but in countries like India, it is extended up to 8 or 10 digits for domestic purposes:

| Digits | Nomenclature | Description |

| First 2 Digits | Chapter | Denotes the broad category of the product. (Example: 09 = Coffee, Tea, Mate and Spices) |

| Next 2 Digits | Heading | Denotes a specific group within that chapter. (Example: 0901 = Coffee, whether roasted or decaffeinated) |

| Next 2 Digits | Sub-Heading | Provides further specific classification within the group. (Example: 0901.11 = Coffee, not decaffeinated) |

| 7th and 8th Digits | Tariff Item / HSN | These are national-level sub-classifications used by countries like India for domestic tariff and statistical purposes. |

| 9th and 10th Digits | Customs Tariff Item | This is the most specific classification and is critical in India for determining the exact Import Duty levied. |

Why Is Using the Correct HS Code Essential?

Misusing the HS Code can impact your business in several ways:

Incorrect Duty Payment: If the code is wrong, you will either pay less duty (resulting in heavy fines from Customs) or more duty (resulting in a financial loss to your business).

Shipment Delays: Customs officials can instantly halt a shipment if they find a discrepancy in the code. Your goods will be stuck at the port, leading to expensive Demurrage charges.

Government Policies: Governments attach specific subsidies, regulations, or restrictions to products based on their HS Codes. An incorrect code may disqualify you from receiving government benefits.

Trade Data: Accurate codes ensure the government collects correct trade data, which is essential for future trade policy formulation.

How Globax Solutions Assists You

Finding the correct HS Code is a technical procedure. Globax Solutions helps you overcome these challenges:

HSN Verification: We help identify the most accurate and legally valid HS Code based on the nature and use of your specific product.

Documentation Accuracy: We ensure there are no discrepancies in the code across your Commercial Invoice, Packing List, and Shipping Bill.

Tariff Guidance: We provide an estimation of the Customs Duty in the target country based on your verified HS Code.

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800