A Guide to Mastering HS Code Classification in India

The Foundation: The Six General Interpretative Rules (GIRs)

The six GIRs are applied sequentially. You must attempt to classify under Rule 1 first, and only move to Rule 2, and so on, if the preceding rule fails to provide a clear answer.

GIR 1: Terms of the Headings & Section/Chapter Notes (The Primary Rule)

The Principle: Classification is determined first and foremost by the terms of the headings (the description of the product at the 4-digit level) and any relevant Section or Chapter Notes.

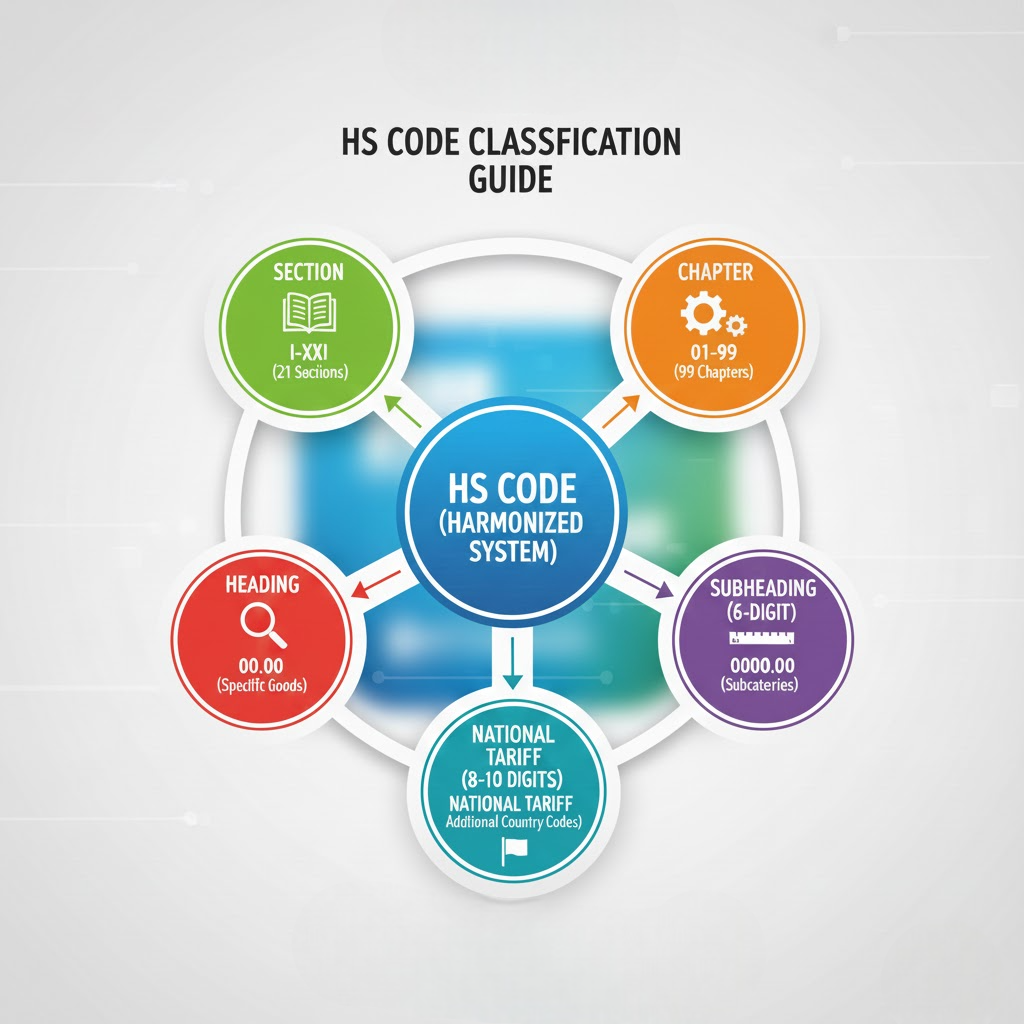

Titles are for Reference Only: The titles of Sections (21 sections) and Chapters (99 chapters) are only for ease of reference and hold no legal weight.

The Legal Text is Key: You must strictly follow the precise language used in the 4-digit Heading and the binding legal notes attached to the Section or Chapter.

GIR 2: Incomplete, Unassembled, and Mixtures

This rule is split into two parts and is used when the classification can’t be resolved by the exact terms of the heading in Rule 1.

GIR 2(a): Incomplete or Unassembled Articles

The Principle: An article that is incomplete or unfinished must be classified as the complete or finished article, provided that the incomplete article has the essential character of the complete article.

Unassembled/Disassembled: Articles presented disassembled or unassembled are also classified as the complete article.

GIR 2(b): Mixtures and Combinations of Materials

The Principle: Any reference to a material or substance in a heading includes mixtures or combinations of that material/substance with others. If goods consist of more than one material, classification proceeds to Rule 3.

GIR 3: Resolving Conflict (Two or More Headings Apply)

If a product could prima facie be classified under two or more headings, Rule 3 provides a strict order of priority:

GIR 3(a): Most Specific Description

The Principle: The heading that provides the most specific description shall be preferred to headings providing a more general description.

GIR 3(b): Essential Character

The Principle: For mixtures, composite goods (made of different materials/components), and goods put up in sets for retail sale, classification should be based on the material or component that gives the goods their essential character.

Determining Essential Character: Factors like the nature of the material, its bulk, weight, value, or the role of the constituent material in relation to the use of the goods are considered.

GIR 3(c): Last in Numerical Order

The Principle: When classification cannot be resolved by Rule 3(a) or 3(b), the goods are classified under the heading which occurs last in numerical order among those equally meriting consideration.

GIR 4: Most Akin

The Principle: Goods which cannot be classified by the preceding rules are classified under the heading appropriate to the goods to which they are most akin (similar). This rule is rarely used and is a last resort.

GIR 5: Packaging and Containers

GIR 5(a): Cases

The Principle: Cases specially shaped or fitted to contain a specific article (e.g., camera cases, musical instrument cases), suitable for long-term use, and presented with the articles they are intended for, are classified with those articles.

GIR 5(b): Packing Materials

The Principle: Normal packing materials and containers (e.g., cardboard boxes, standard plastic wrapping) are classified with the goods. This doesn’t apply if they are clearly suitable for repetitive use (e.g., specialized steel drums).

GIR 6: Subheading Classification (The 8-Digit Rule)

The Principle: Classification at the subheading level (the final 8 digits in India) shall be determined according to the terms of those subheadings and any related Subheading Notes, mutatis mutandis (by repeating the application of the above Rules).

The Indian Addition: In India, this rule is used to move from the 6-digit HS code (international) to the 8-digit ITC-HS Code (national tariff item), which is crucial for determining specific Customs Duty and DGFT policy, like RoDTEP rates.

Globax Solutions: Classify with Confidence

Globax Solutions: Classify with Confidence

Accurate HS classification is the foundation of successful trade compliance. In India, the difference between an 8-digit code can mean the difference between a high duty rate and a concession, or eligibility for a vital export incentive.

We ensure your classification is audit-proof by:

Applying the GIRs Sequentially: Moving systematically through the rules to establish the most legally defensible classification.

Checking Section & Chapter Notes: Ensuring all exclusionary and inclusionary notes are considered (the key to Rule 1).

Finalizing the 8-Digit Code: Verifying the selected 6-digit classification against the ITC-HS 8-digit schedule to secure the correct national tariff item for customs and DGFT compliance.

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800

Globax Solutions: Classify with Confidence

Globax Solutions: Classify with Confidence