Your Compliance Compass: Step-by-Step Export Registration Process in India

Phase 1: The Foundational Legal Setup

This phase establishes the legal identity and financial backbone of your exporting entity.

Step 1: Establish Your Business Entity & PAN

You must first lay the legal groundwork for your business (Sole Proprietorship, Partnership, LLP, or Company).

Mandatory: Obtain a Permanent Account Number (PAN) from the Income Tax Department. The PAN is the foundation for all subsequent registrations, as the IEC is now PAN-based.

Step 2: Open a Foreign Exchange Bank Account

All international transactions must be routed through a dedicated business account.

Action: Open a Current Account with a bank authorized to deal in Foreign Exchange (an AD Category-I bank). This account is crucial for receiving export proceeds and registering your AD Code with Customs.

Step 3: Obtain GST Registration

While exports are zero-rated, GST registration is still essential for filing the Shipping Bill (the customs document) and for claiming the refund of taxes paid on raw materials and input services (GST Refund/ITC).

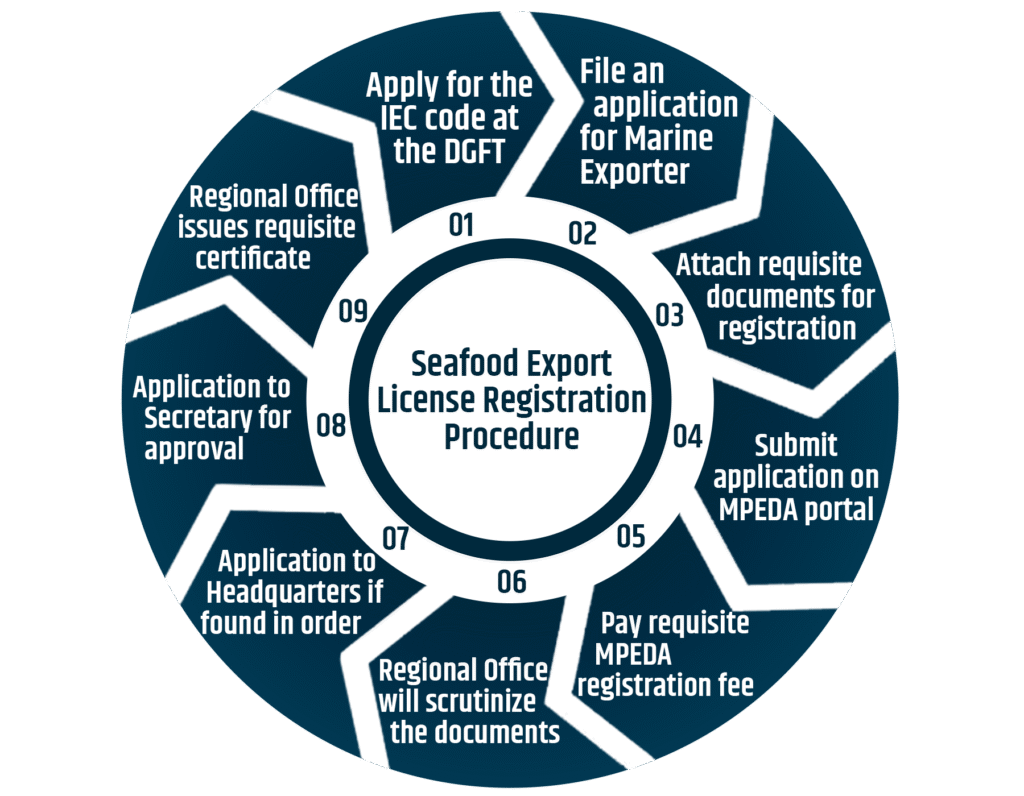

Phase 2: The Mandatory Export Licenses

These are the primary licenses that give you the legal authority to engage in international trade.

Step 4: Secure the Importer-Exporter Code (IEC)

This is your global trade passport, issued by the DGFT. No person or entity can make any import or export without an IEC.

Process: The application is entirely online on the DGFT website (

dgft.gov.in). It requires PAN details, firm details, bank details, and address proof.Validity: The IEC has lifetime validity but must be updated annually between April and June (even if details are unchanged) to remain active. Failure to update leads to deactivation.

Globax Solution: We handle the entire online IEC application and the mandatory annual update process, saving you time and ensuring compliance.

Step 5: Register with the Export Promotion Council (RCMC)

The Registration-cum-Membership Certificate (RCMC) is obtained from the relevant Export Promotion Council (EPC), Commodity Board, or FIEO (Federation of Indian Export Organisations).

Why it’s Crucial: RCMC is mandatory for availing benefits, concessions, and incentives under the Foreign Trade Policy (e.g., the RoDTEP scheme).

Action: Choose the council that corresponds to your main line of business (e.g., APEDA for processed food, AEPC for apparel).

Phase 3: Customs and Port Registration

These steps ensure your goods can be physically cleared at the port of export.

Step 6: Register the AD Code with Customs (Port Registration)

The Authorised Dealer (AD) Code is issued by your bank, allowing Customs to track and link your foreign exchange transactions to your exports.

Process: The AD Code must be electronically registered on the ICEGATE portal (Indian Customs Electronic Gateway) with the Customs authorities at every port (sea, air, or dry port) from which you plan to export.

Mandatory for Clearance: Without AD Code registration at the specific port, Customs will not allow you to file the Shipping Bill, blocking your shipment.

Step 7: Finalize Customs and Business Identification Number (BIN)

The Business Identification Number (BIN) is essentially the combination of your GSTIN and the registered AD Code.

Action: Ensure your GSTIN is properly linked and registered with Customs. This link is vital for receiving all benefits like Duty Drawback and IGST refunds directly into your bank account.

Your Export Registration Checklist

| Document/Registration | Authority | Purpose |

| PAN Card | Income Tax Dept. | Mandatory legal identity of the firm. |

| Current Account | AD Category-I Bank | For receiving foreign payments. |

| GSTIN | GST Authorities | Mandatory for tax compliance & filing Shipping Bill. |

| IEC | DGFT | Mandatory license for all import/export activities. |

| RCMC | EPC/Commodity Board | Mandatory for availing export incentives (RoDTEP). |

| AD Code Registration | Customs (ICEGATE) | Mandatory for customs clearance at each port. |

Don’t Risk Delay: Partner with Globax Solutions

The export registration process involves multiple portals, various government agencies, and precise documentation. A single mismatch in name, address, or bank details can halt the process for weeks.

Globax Solutions is your dedicated compliance partner, specializing in:

End-to-End Registration: We manage the entire process, from IEC application to AD Code registration at your chosen ports.

Annual Compliance: We handle the mandatory annual updation of your IEC and RCMC, ensuring your license remains active.

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800