Commercial Invoice Format for Export – Globax Solutions

A Commercial Invoice for export plays a critical role in global trade. It acts not only as a proof of sale but also as a vital document for customs clearance. Whether you’re a new exporter or an experienced business owner, understanding the correct format and components of this document is essential for smooth operations and international trade compliance.

At Globax Solutions, we help exporters streamline their export documentation process and ensure they are compliant with the standards of Indian export documentation as well as international trade regulations. Let’s explore the importance, format, and requirements of a Commercial Invoice in the export industry.

Understanding the Commercial Invoice in Indian Export Compliance

A Commercial Invoice is more than just a bill. It serves as a legal document between the exporter (seller) and importer (buyer), issued by the exporter to the buyer, specifying the type, quantity, and value of the goods being sold.

It is mandatory for customs clearance, duty assessments, and verification of goods by Indian and foreign customs authorities. Without a properly formatted Commercial Invoice, exporters can face delays, penalties, or shipment rejections.

What Makes the Commercial Invoice So Important?

- Trade Documentation India relies heavily on accurate invoices for validation of the shipment’s value and details.

- The Commercial Invoice for export is used by Indian exporters to apply for incentives under schemes like RoDTEP or Advance Authorisation.

- It’s also a requirement during bank procedures under Letter of Credit or Advance Payments.

At Globax Solutions, we understand that mistakes in documentation can cost exporters their deals. That’s why we provide end-to-end guidance on every aspect of export documentation in India, including the correct format of the Commercial Invoice.

Format and Components of a Commercial Invoice for Export

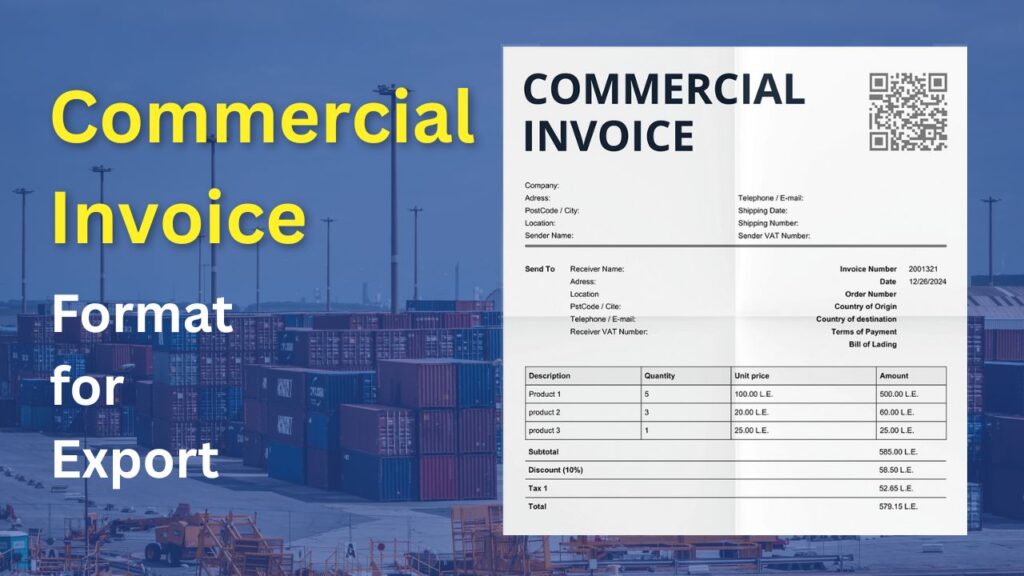

An ideal Commercial Invoice format for export should be clear, compliant, and internationally accepted. Here’s a typical layout used in Indian export certificate processes and by global buyers.

Key Sections Included in a Commercial Invoice:

- Exporter’s Details – Name, address, contact, and IEC number

- Buyer’s Details – Full name and address of the buyer (importer)

- Invoice Number & Date – Unique number and date of issue

- Buyer’s Purchase Order Number – Reference to the order received

- Country of Origin & Destination – Country where goods are manufactured and being shipped

- Description of Goods – Detailed product name, grade, model, or specifications

- HS Code – Harmonized System Code for product classification

- Quantity and Unit – Number of units and unit of measure

- Unit Price and Total Value – Price per unit and total value in foreign currency

- Currency Used – USD, EUR, GBP, INR, etc.

- Terms of Delivery (Incoterms) – e.g., FOB, CIF, DDP

- Payment Terms – Mode and terms of payment

- Bank Details – Exporter’s bank name, SWIFT code, account number, etc.

- Declaration & Signature – Exporter’s declaration and authorized signature

This format ensures that your Indian export certificate process aligns with global buyer requirements and avoids disputes or delays.

At Globax Solutions, we not only assist in preparing the correct invoice but also help integrate it with other key documents like Shipping Bill, Bill of Lading, and Certificate of Origin.

Assistance from Globax Solutions for Export Invoicing

Correct invoicing is not just about filling in blanks – it’s about knowing what to write, how to format, and how to meet trade regulations.

Preparing Your Invoice with Correct Export Documentation India

When you start your first export shipment, our team at Globax Solutions helps you compile your full set of export documents. The Commercial Invoice is usually accompanied by:

- Packing List

- Shipping Bill

- Export License or Certificate (if required)

- Certificate of Origin

- RCMC or APEDA/FIEO Certificate (sector-specific)

This bundle is crucial for customs clearance, and each document must match the details provided in the Commercial Invoice for export.

Our support ensures your documents are:

- Digitally Compliant with DGFT online registration India

- Formatted as per Indian customs norms

- Linked to your GST registration for export business and AD Code

Your invoice must also reflect accurate currency conversion if selling in USD or Euros, along with a GST exemption if exporting under LUT/Bond.

Avoiding Mistakes in Trade Documentation India

Many new exporters in India make errors like:

- Missing HS code

- Incorrect buyer name or port of destination

- Not mentioning Incoterms

- Using domestic invoice instead of export invoice format

These mistakes can lead to customs queries or payment rejections.

At Globax Solutions, we guide exporters to digitally file the correct invoice while integrating their GST and shipping bill details, so that the Certificate of Origin and e-BRC (Bank Realization Certificate) also align seamlessly.

Our expertise ensures your Commercial Invoice format for export meets not just Indian norms, but is acceptable across markets like the USA, Europe, UAE, and Asia.

Export Licensing and Supporting Documents with Invoice

Your Commercial Invoice for export should always be supported by licensing and compliance documents, especially if you’re dealing with regulated goods.

Export License and Certificate of Origin

Many countries require specific origin proofs. Here’s how Globax supports:

- If you’re exporting handicrafts, textiles, agri-products, we guide you in getting the correct RCMC (Registration-Cum-Membership Certificate).

- We help you apply for the Certificate of Origin India (preferential or non-preferential), digitally through DGFT portal or Chambers of Commerce.

- Our experts ensure your invoice references the origin certificate, making your trade documentation India 100% valid and accepted globally.

The invoice must also reflect the licensing authority if you’re using schemes like MEIS, RoDTEP, or other Indian export compliance schemes.

Role of Exporter’s Bank and AD Code in Invoicing

Another hidden element often ignored is banking compliance.

- The invoice must match the AD Code registered at port, otherwise your Shipping Bill may get rejected.

- We ensure your invoice and shipping bill are linked to the correct AD code registration for export, preventing rejection during e-BRC issuance from your bank.

These aspects of Indian export certificate process are simplified by Globax Solutions, where our support team cross-checks all inputs before final document submission.

Why Choose Globax Solutions for Export Documentation Support

The biggest hurdle Indian exporters face is documentation compliance. From issuing a proper Commercial Invoice format for export, to syncing it with customs systems, Globax Solutions offers full documentation and advisory support.

Trusted Guidance from Indian Export Documentation Experts

- Assistance in drafting & validating invoices as per DGFT norms

- Integration with shipping and banking compliance

- Guidance for RoDTEP claim filing, post invoice

- Custom invoice templates aligned with buyer and customs format

- Country-specific invoice requirements (like EORI for Europe, FDA declaration for US)

Our team ensures your exports are not only compliant but also fast-tracked by avoiding costly errors.

Integrated Services for End-to-End Export Success

We don’t stop at invoicing. With Globax, you get:

- Export Import Training for your staff

- AD Code Registration and GST setup for exports

- Digital marketing for exporters

- Help in getting buyers from international markets

- Website development for exporters to display products and accept inquiries

Your Commercial Invoice is just the beginning. We make sure the entire export documentation India process works smoothly, legally, and efficiently.

A Reliable Export Invoice Process with Globax Solutions

A professionally structured Commercial Invoice for export ensures your products pass through customs without delays and that your buyers release payments on time. At Globax Solutions, we know that exporters need clarity, speed, and compliance in documentation to thrive in the Rs. 36 lakh crore Indian export market.

If you’re starting your journey or want to scale your exports, trust us to handle your trade documentation India and streamline your Indian export compliance.

Let Globax Solutions be your partner for success – from issuing the perfect Commercial Invoice to delivering your goods to global buyers with full legal and financial security.

Contact Globax Solutions today to simplify your export journey!

Contact Globax Solutions today to simplify your export journey!

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800