Mastering the Commercial Invoice Format

Introduction: The Gateway to Global Clearance

The Hook: If the cargo is the body of the shipment, the Commercial Invoice (CI) is its brain. It is the core document that governs the entire trade transaction, telling customs, banks, and carriers everything they need to know—from the value of the goods to the duties owed.

The Problem: An incomplete or incorrectly formatted Commercial Invoice is the number one cause of customs delays, fines, and rejections in international trade.

The Globax Pledge: At Globax Solutions, we believe perfect documentation is the foundation of efficient logistics. This guide breaks down the essential format requirements for the Commercial Invoice, ensuring your financial and legal compliance is flawless, shipment after shipment.

Section 1: What is the Commercial Invoice?

1.1 CI vs. Proforma Invoice

Proforma Invoice: A preliminary bill of sale used to obtain financing (like an L/C) or for the buyer’s initial import permit application. It’s an estimate.

Commercial Invoice (CI): The final, binding document detailing the actual goods shipped and the final terms. It accompanies the goods and is used by customs for valuation.

1.2 The CI’s Triple Duty

Customs Valuation: Provides the basis for calculating import duties, tariffs, and taxes.

Payment Processing: Required by banks and financial institutions for releasing payment (especially under Letters of Credit).

Ownership Transfer: Confirms the final sale from the seller (exporter) to the buyer (importer/consignee).

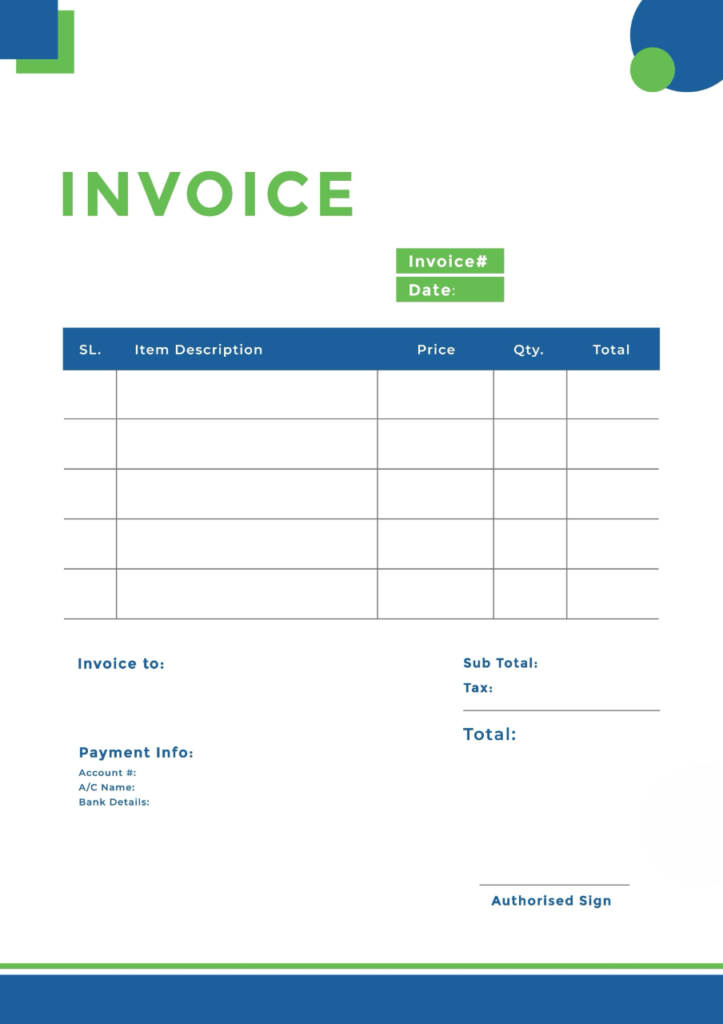

Section 2: The Non-Negotiable Format Requirements (Field-by-Field)

The structure of the CI must be consistent and contain these mandatory data points.

1. The Parties and References

| Field | Requirement | Compliance Note |

| Exporter/Seller | Full legal name, address, phone, email, and Tax ID/EIN/VAT Number. | Must match the entity on the export declaration. |

| Importer/Consignee | Full legal name, address, phone, email, and Tax ID/Importer of Record Number (crucial for valuation). | Must be the legally registered importer in the destination country. |

| Invoice Number | Unique, sequential number assigned by the seller. | Necessary for accounting and L/C processing. |

| Date of Issue | The date the CI was prepared. | Must precede or match the date of shipment. |

2. Shipment & Carrier Details

Incoterms® 2020: State the Incoterm (e.g., FCA Shanghai, DAP New York) and the named location. This is critical as it defines the value included in the price (e.g., FOB vs. CIF value).

Method of Transport: (e.g., Ocean, Air, Truck) and the Carrier’s Name.

Ports & Destination: Port of Loading, Port of Discharge, and Final Delivery Location.

3. Detailed Goods Description (The Core of Compliance)

This section requires the most attention, as it drives customs classification.

Full Description: A detailed, technical, and commercial description of the item (e.g., “Stainless Steel Hex Bolt, Grade 304, Size M10-1.5 x 50mm”).

HS Code (Harmonized System Code): The universally recognized 6-digit classification code (or up to 10 digits in some countries). This code determines the duty rate.

Country of Origin (COO): The country where the goods were wholly obtained or last substantially transformed. Required for tariff and free trade agreements.

Quantity & Unit of Measure: The number of units (e.g., 5,000 Pieces, 100 Kilograms).

Unit Price: The selling price per unit.

Total Price: Quantity multiplied by Unit Price.

4. Financial Summary

Subtotal: Total value of all goods.

Itemized Charges: Clearly list any additional charges included in the final price:

Freight/Shipping Charges (if included in the Incoterm price).

Insurance Charges (if included).

Packing or Handling Fees.

Total Invoice Value: The final sale amount. This figure is the basis for duty calculation.

Currency: The currency of the total sale (e.g., USD, EUR).

Section 3: Special Clauses and Signatures

These clauses provide the necessary legal assurance and final confirmation.

5. Incoterms Declaration Statement

Provide a specific statement confirming the chosen Incoterm and its location (e.g., “The price indicated on this invoice is based on Incoterms® 2020: DAP – 123 Main Street, Miami, FL, USA.”)

6. Export Reason and Terms of Sale

Clearly state the reason for export (e.g., Sale, Repair & Return, Gift/Sample, Temporary Import).

State the agreed-upon payment terms (e.g., T/T 30 Days, Letter of Credit, Cash in Advance).

7. Declaration, Signature, and Stamp

Include a standard declaration statement (e.g., “We certify that the goods listed herein are true and correct and that the value stated is the full selling price.”)

The CI must be dated, signed by an authorized representative, and stamped with the company seal (if applicable).

Section 4: Globax Solutions Best Practices

❌ Common CI Pitfalls

Valuation Errors: Listing a sample/gift at zero value. All items, even if free, must show a fair market value for customs.

Missing HS Codes: Failing to classify the goods correctly leads to customs guessing, often resulting in the highest possible duty rate.

Inconsistent Currency: Quoting a price in USD but failing to explicitly state “USD” on the document.

Handwritten Edits: The CI must be clean, typed, and free of manual corrections, which raise immediate red flags for customs.

✅ The Globax Advantage

Use the 6-Digit HS Code: Even if your country only requires 6 digits for export, always use the buyer’s 8- or 10-digit code when known to aid import customs clearance.

Include Country of Origin on the Line Item: Instead of just in the header, placing the COO next to the product description reduces confusion when multiple countries of origin are involved.

Provide Multiple Copies: Always send the CI with the freight, but also email soft copies (PDFs) to the buyer and your freight forwarder/customs broker in advance.

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800