Why Your HS Code Finder for India Matters

What is the HS Code and Why is it 8 Digits in India?

The Harmonized System (HS) is an internationally standardized system of names and numbers developed and maintained by the World Customs Organization (WCO) to classify traded products.

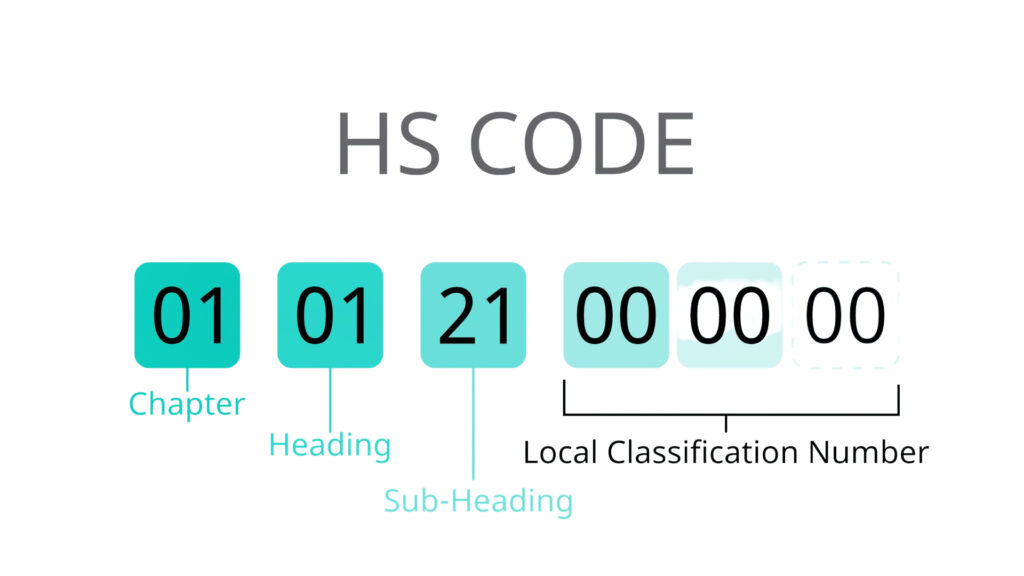

The structure of the HS Code is hierarchical and logical, like a scientific classification system:

| Digits | Name | Function | Classification Level |

| First 2 | Chapter | Broad product category (e.g., 61: Articles of apparel and clothing accessories, knitted or crocheted) | International (Global) |

| Next 2 (4 Total) | Heading | Specific product family (e.g., 61.05: Men’s or boys’ shirts, knitted or crocheted) | International (Global) |

| Next 2 (6 Total) | Sub-Heading | Very specific product type (e.g., 6105.10: Of cotton) | International (Global) |

| Next 2 (8 Total) | ITC-HS Code | National Tariff Item (India-specific classification) | National (India) |

In India, the 8-digit code is officially known as the ITC-HS Code (Indian Trade Classification based on the Harmonized System).

The 8th Digit Difference: While the first six digits are globally consistent, India adds the final two digits to:

Impose specific Customs Duty rates.

Define specific import/export policies (e.g., “Restricted,” “Prohibited,” or “Free”).

Offer detailed export benefits under schemes like RoDTEP and Advance Authorisation.

💰 The Critical Role of the HS Code in Indian Export & Import

The HS Code is the lynchpin for nearly every step in the import-export lifecycle. A correct classification ensures:

1. Customs Compliance and Duty Calculation

Imports: The HS Code directly determines the Basic Customs Duty (BCD) and any other applicable taxes (like Anti-Dumping Duty or Safeguard Duty) on imported goods. Incorrect classification can lead to underpayment, resulting in heavy fines and seizure of goods.

Exports: While most Indian exports are duty-free, the code is essential for all documentation, including the Shipping Bill.

2. Accessing DGFT Export Incentives

Your product’s eligibility and the corresponding incentive rate for key government schemes are entirely dependent on the 8-digit ITC-HS Code:

RoDTEP/RoSCTL: The percentage of tax refund you receive is published in the RoDTEP Schedule against your specific 8-digit code. Use the wrong code, and you risk getting a lower refund or none at all.

Advance Authorisation (AA): The Standard Input-Output Norms (SION), which determine the quantity of duty-free inputs you can import, are mapped directly to your final product’s HS Code.

Export Promotion Capital Goods (EPCG): While the main focus is on the capital goods imported, the scheme’s overall compliance is tied to your export products’ HS Codes.

3. Trade Policy Restrictions and Regulations

The DGFT uses the ITC-HS Code to enforce national trade policy:

It specifies whether an item is Freely Exportable/Importable or falls under the Restricted or Prohibited list (e.g., certain defense goods or wildlife items require special licenses based on their HS Code).

It identifies goods subject to SCOMET (Special Chemicals, Organisms, Materials, Equipment and Technologies) regulations, requiring stringent authorization.

4. Global Market Intelligence

The 6-digit HS Code is the global standard for tracking international trade statistics. By knowing your correct code, you can:

Analyze global demand, market sizes, and top importing countries for your product using global databases (like UN Comtrade).

Identify competitors and benchmark pricing.

💡 Globax Solutions: Your Accurate HS Code Finder

Manually navigating the thousands of codes and rules of interpretation in the DGFT’s ITC-HS schedule can be prone to errors. That’s why Globax Solutions offers a robust and user-friendly HS Code Finder tool, ensuring your business stays compliant and financially optimized.

How Our Finder Ensures Accuracy

Product Description Search: Simply enter the product name or keywords, and our tool uses its intelligence engine to suggest the most likely 8-digit ITC-HS Codes.

Compliance Check: Every result is linked to the latest Customs Duty structure, Import Policy (Restricted/Free), and eligibility status for major export incentive schemes.

Eliminate Guesswork: We help you understand the nuances between similar codes, ensuring you use the most specific and accurate classification based on material, function, and form.

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800