Maximizing Profit: A Guide to Export Incentives in India

Introduction: Boosting Competitiveness with Government Support

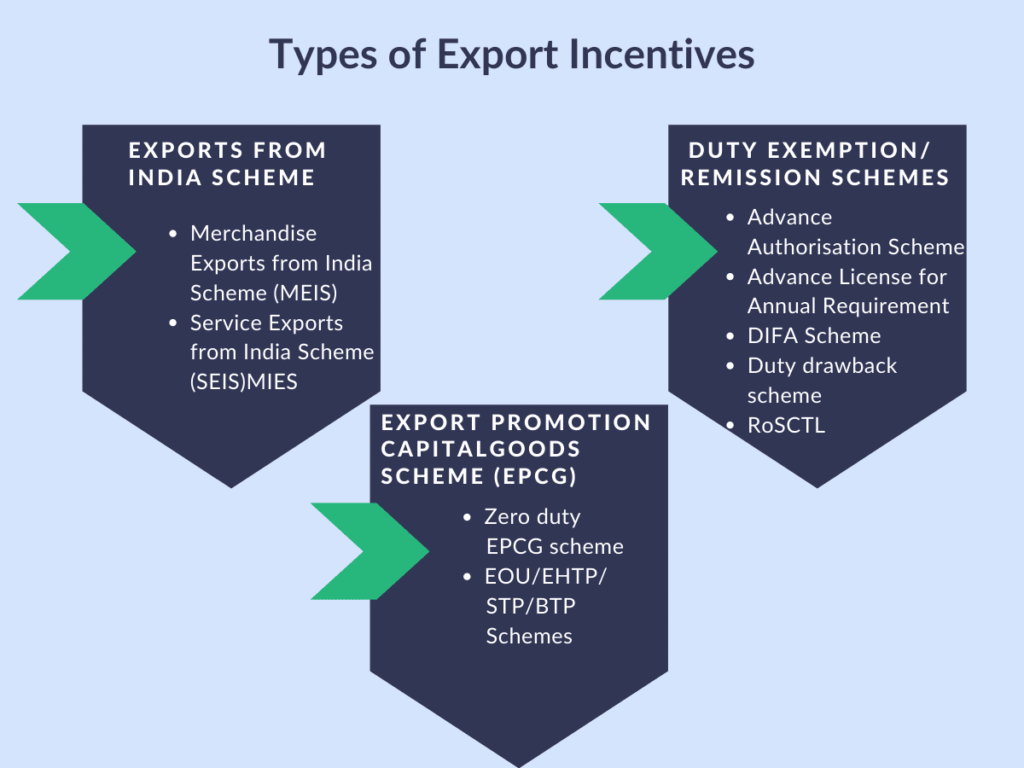

India’s government actively promotes exports to bolster foreign exchange earnings and drive economic growth. To achieve this, the Directorate General of Foreign Trade (DGFT), under the Ministry of Commerce & Industry, implements various schemes outlined in the Foreign Trade Policy (FTP).

These export incentives are essential financial benefits that help Indian exporters recover embedded taxes, reduce input costs, and enhance their global competitiveness.

At Globax Solutions, we specialize in ensuring you correctly claim every single rupee of benefit you are entitled to.

1. The Primary Duty Neutralisation Scheme: RoDTEP

The Remission of Duties and Taxes on Exported Products (RoDTEP) scheme is currently the cornerstone of India’s export promotion efforts, having replaced the earlier MEIS (Merchandise Exports from India Scheme).

What is RoDTEP?

RoDTEP aims to reimburse exporters for embedded taxes and duties that were previously non-refundable under GST, customs, or central excise laws. These include:

Central/State taxes on fuel used for transportation.

VAT/Entry Tax on inputs used in production.

Taxes on electricity used during manufacturing.

The remission is provided as transferable duty credit scrips, which can be used to pay basic customs duty on imported goods or sold in the market for cash.

Globax Advantage Point

RoDTEP rates are calculated based on the 8-digit HS Code of the exported product. Correct HSN classification is critical to ensure you get the maximum allowable rate.

2. Duty Drawback Scheme 📜

The Duty Drawback scheme is designed to refund customs duty paid on imported inputs and Central Goods and Services Tax (CGST) and State Goods and Services Tax (SGST) paid on domestic inputs that are physically incorporated into the final exported product.

Types of Drawback:

All Industry Rate (AIR): A fixed rate applicable to a class of goods, based on average consumption of inputs. This is the most common route.

Brand Rate: A specific rate determined for an individual manufacturer where the AIR is insufficient or not notified, requiring detailed cost data.

Compliance Note

To claim Drawback, the exporter must declare their intention on the Shipping Bill. The refund is typically processed automatically after the Export General Manifest (EGM) is filed and the Let Export Order (LEO) is granted.

3. Advance Authorisation Scheme (AAS)

The Advance Authorisation Scheme is an input entitlement scheme designed for duty-free import of raw materials/inputs that will be used to manufacture the product being exported.

How it Works:

The exporter receives a license (Authorisation) from the DGFT.

They can then import specified quantities of inputs without paying customs duty (including BCD, IGST, etc.).

The final manufactured product must be exported within a defined period (usually 18 months), fulfilling the Export Obligation (EO).

The Benefit

AAS is crucial for exporters whose competitiveness relies heavily on the cost of imported raw materials, effectively neutralizing the customs duty component.

4. Export Promotion Capital Goods (EPCG) Scheme 🛠️

The EPCG Scheme allows manufacturers to import capital goods (machinery, equipment, tools, spare parts) at zero customs duty for the production of export goods.

The Condition: Export Obligation

To avail of this benefit, the importer must meet an Export Obligation (EO) equivalent to six times the duty saved on the imported capital goods, to be fulfilled over a period of six years from the date of issue of the authorisation.

Who Benefits?

This scheme is excellent for manufacturers looking to modernize their production facilities and scale up their export capacity, offering a major capital cost advantage.

5. Other Important Incentives

| Scheme | Purpose | Benefit |

| GST Refunds | Recovery of GST paid on goods and services used for export. | IGST paid on exported goods or accumulated ITC (Input Tax Credit) is refunded. |

| SEZ/EOU Schemes | Special benefits for units operating in Special Economic Zones or as Export Oriented Units. | Duty-free import/domestic procurement, tax exemptions, and simplified procedures. |

| Marketing Assistance (MAI) | Financial assistance for promotion activities. | Grants to participate in international trade fairs, exhibitions, and for market research. |

Conclusion: Turning Entitlement into Profit

India’s export incentive structure is robust but requires meticulous compliance and timely filing. Missing a deadline or making an error on a Shipping Bill can lead to forfeiture of significant benefits, directly impacting your bottom line.

By accurately understanding and utilizing schemes like RoDTEP, Duty Drawback, and the AAS, you can substantially reduce your operational costs and offer more competitive pricing globally.

At Globax Solutions, we don’t just facilitate logistics; we ensure you capitalize on every export incentive available, turning compliance into profit.

Ready to calculate your potential export incentive claims under RoDTEP and Duty Drawback?

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800