Export promotion schemes India

India's Export Powerhouse: Your 2025 Guide to Top Export Promotion Schemes

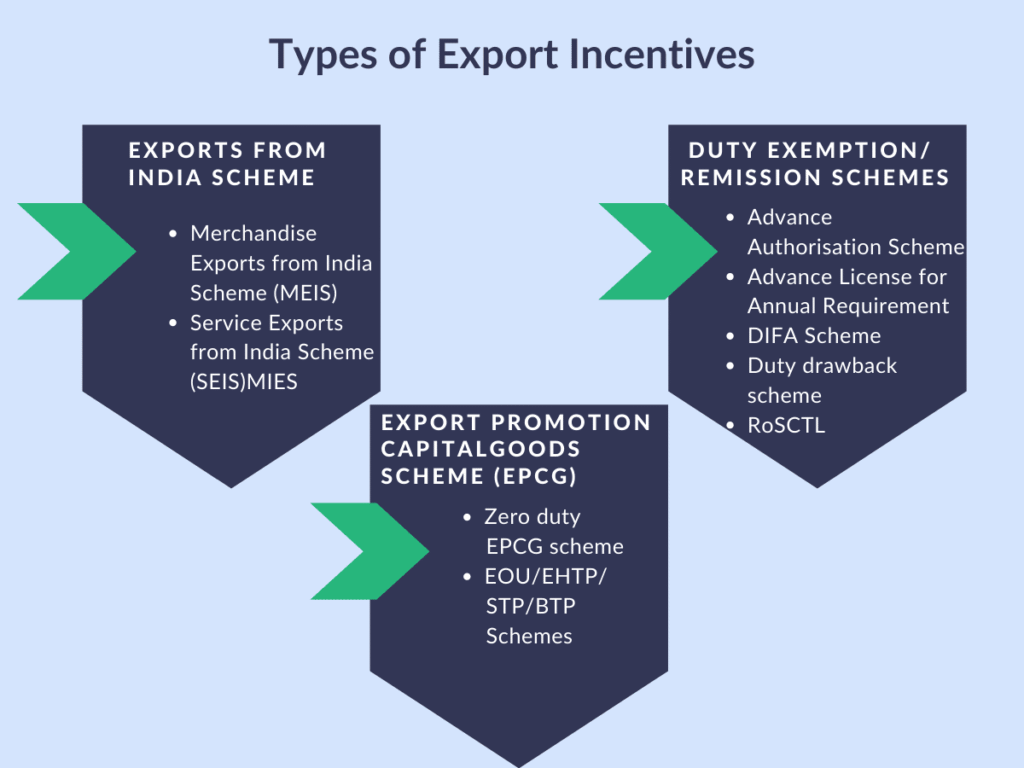

The Core of Export Incentives: Why These Schemes Matter

The Government of India, through the Directorate General of Foreign Trade (DGFT), offers schemes to neutralise local taxes, reduce the cost of credit, and facilitate duty-free import of raw materials and capital goods.

For an exporter, these schemes translate directly into:

Lower Production Costs: By refunding taxes and allowing duty-free imports.

Enhanced Competitiveness: Making your products/services more attractive globally.

Improved Working Capital: Through interest subsidies and faster refunds.

1. RoDTEP (Remission of Duties and Taxes on Exported Products): The Game Changer

The RoDTEP scheme is the successor to the Merchandise Exports from India Scheme (MEIS) and is fully compliant with WTO guidelines. It is perhaps the most fundamental incentive for goods exporters.

| Feature | Key Benefit |

| What it Reimburses | Hidden central, state, and local taxes/duties (e.g., VAT on fuel, electricity duty, Mandi tax) that are not refunded under GST. |

| How it Works | Benefits are provided as transferable Duty Credit e-scrips (digital credits) that can be used to pay Basic Customs Duty on imports or sold for cash. |

| Globax Insight | The scheme is fully digital (via the ICEGATE portal), aligning perfectly with the e-commerce export boom. Ensure your shipping bill explicitly claims RoDTEP. |

2. Advance Authorisation (AA) Scheme: For Duty-Free Raw Material

The AA Scheme directly addresses a core cost component: the raw materials used in your export product.

| Feature | Key Benefit |

| What it Allows | Duty-free import of raw materials, components, consumables, fuel, oil, and catalysts used in the manufacture of export products. |

| The Obligation | The exporter must fulfill an Export Obligation (EO) by exporting the finished goods within a set time frame (typically 18 months). |

| Globax Insight | This scheme is ideal for exporters with high-value inputs. It eliminates the upfront payment of customs duties (including Basic Customs Duty, IGST, and Compensation Cess), offering significant cash flow benefits. |

3. EPCG (Export Promotion Capital Goods) Scheme: Zero-Duty Machinery

Looking to upgrade your factory with the latest global technology? The EPCG scheme makes it significantly cheaper.

| Feature | Key Benefit |

| What it Allows | Zero customs duty import of capital goods (machinery and equipment) for pre-production, production, and post-production. |

| The Obligation | The exporter must fulfill an export obligation equivalent to 6 times the duty saved on the capital goods, to be completed within 6 years. |

| Globax Insight | The EPCG scheme is essential for long-term competitiveness. By reducing the cost of high-quality machinery, it directly boosts product quality and production efficiency, a major selling point in international markets. |

4. Interest Equalisation Scheme (IES): Cheaper Export Credit

Access to affordable working capital is a persistent challenge for MSMEs. The IES provides a direct financial boost.

| Feature | Key Benefit |

| What it Offers | An interest subsidy on Pre-Shipment and Post-Shipment Rupee Export Credit. |

| Benefit Rate | Up to 3% to 5% interest subvention, significantly reducing your cost of borrowing. |

| Globax Insight | This scheme is crucial for MSMEs and sectors with tight working capital. It directly addresses the “cost of credit” bottleneck, allowing you to take on larger, more profitable export orders. |

5. Other Key Incentives to Know

RoSCTL (Rebate of State and Central Taxes and Levies): A specialized version of RoDTEP specifically designed for the Apparel and Textile sector.

Duty Drawback Scheme (DBK): Provides a refund of customs and central excise duties paid on inputs used in the manufacture of exported goods.

Market Access Initiative (MAI): Offers financial assistance for export promotion activities such as participation in international trade fairs, market studies, and product registration/certification in foreign countries.

💡 Globax Solutions: Maximizing Your Export Benefits

Understanding and successfully claiming these benefits requires meticulous documentation and deep knowledge of DGFT’s Foreign Trade Policy.

At Globax Solutions, we don’t just connect you to global buyers; we ensure your business structure is optimized to leverage every available incentive.

Our services can help you:

Determine the optimal scheme mix based on your product and export volume.

Ensure 100% compliance for seamless, timely claim disbursement.

Digitally manage all DGFT applications (RoDTEP e-scrips, AA, EPCG) on the respective government portals.

Contact us for more details of & Your registration

Our team will be happy to assist you

Mobile: +91-790-200-2800